Westmont Magazine Thinking Fast and Slow with Daniel Kahneman

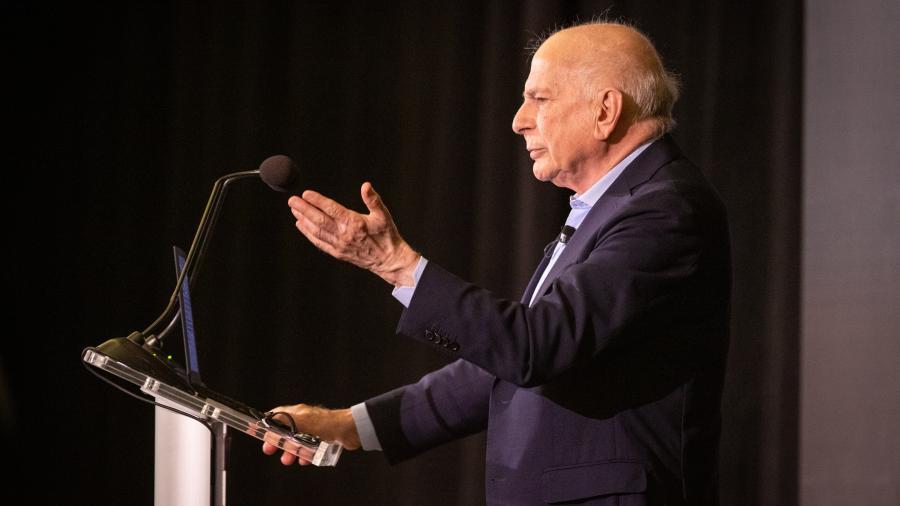

One of the world’s most important thinkers, Daniel Kahneman has made a profound impact on many fields, including economics, medicine and politics. He won the Nobel Prize in Economics in 2002 for his influential work on behavioral economics and the psychology of judgment and decision-making. His ground- breaking book, “Thinking, Fast and Slow,” is an international bestseller. He shared his insights at the 15th annual Westmont President’s Breakfast on March 6, the last large public event Westmont held during spring semester.

An Israeli-American psychologist, Kahneman taught at Princeton University and Hebrew University in Jerusalem, where he earned a bachelor’s degree in psychology. He completed a doctorate in psychology at the University of California, Berkeley. But this psychologist is best known for his work in economics. The Economist listed him as the seventh most influential economist in the world, and Foreign Policy magazine named him a top global thinker. He has won the Distinguished Scientific Contribution Award of the American Psychological Association (1982), the Lifetime Contribution Award of the American Psychological Association (2007) and the Presidential Medal of Freedom (2013). As a young Israeli Army officer in the 1950s, Kahneman designed an interviewing system still in use today. This experience set an important direction for his career. He insisted that interviewers ask each applicant the same series of objective, factual questions about six characteristics considered essential in a soldier. Inter- viewers objected, saying they’d prefer to rely on their judgment and intuition. Kahneman stood firm about asking all the questions but allowed them to make a general assessment at the end about the applicant’s fitness for the army.

“When intuition comes too fast, it’s not reliable,” Kahneman said. “It’s better to collect all the data first and then close your eyes and be intuitive.”

He later developed this idea as fast thinking (based on gut reactions, intuition and emotion) and slow thinking (logical, data-driven deliberation) and argued that slow thinking always proved more reliable and accurate. A long partnership between Kahneman and Amos Tversky, a fellow Israeli psychologist, yielded valuable new research and insight into the ways we judge, predict and make decisions. People turn out to be wrong too often because they base decisions on stereotypes and their own experiences, beliefs and emotions rather than on data.

Kahneman discussed our aversion to loss, noting how few people would wager $200 over the flip of a coin. “That bet has a better rate of return than many investments,” he said. “People reject it because losses loom larger than gains, which is as a fundamental observation about risk in economics.” Betting on a series of coin flips will likely produce winnings, but most people focus on the potential for losing what likely amounts to a small fraction of their personal wealth. They make a mistake by framing the issue too narrowly. “The essence of rationality is broad framing,” Kahneman said. “When we make decisions in isolation, we frame them too narrowly. But we practice broad framing by making decisions in the context of other decisions."

When people plan on the basis of their past experiences, they generally err on the side of optimism, which Kahneman describes as the planning fallacy. It’s difficult to overcome this emotional reaction and instead focus on the facts and take a broader view of how long it will actually take to accomplish a series of tasks.

“When you delay intuition and frame broadly, you’ll think better than people who don’t,” Kahneman said.

The Westmont Foundation, local businesses and individuals sponsor the President’s Breakfast to promote discussion of significant issues. Bank of the West is the Lead Sponsor this year. Gold Sponsors include Canterbury Consulting, Davies, In Memory of Jim Haslem, HUB International Insurance Services, La Arcada, MATT Construction, Lindsay and Laurie Parton, Santa Barbara Capital, Warren and Mary Lynn Staley, Peter and Monique Thorrington, Union Bank and V3.